These four small cap funds managed to beat benchmark in last one year: Do you own any?

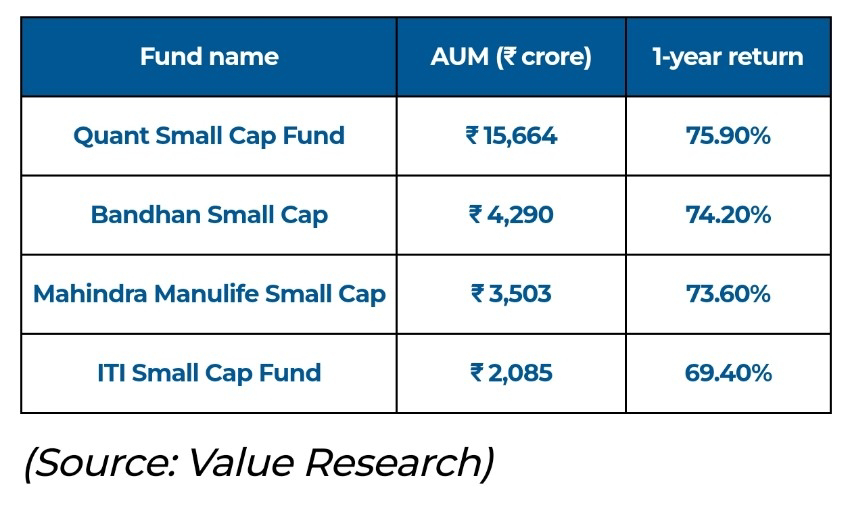

In a recent evaluation by Value Research, four small-cap funds have demonstrated stellar performance, surpassing their benchmarks over the last 12 months. As of February 23, 2024, the returns and assets under management (AUM) figures as of January 31, 2024, reveal the success of these funds.

*Quant Small Cap Fund,* with an AUM of ₹15,664 crore, stands out as a top performer, delivering a 75.9% return in the past year.

*Bandhan Small Cap Fund* follows closely with a 74.2% return, managing an AUM of ₹4,290 crore.

*Mahindra Manulife Small Cap Fund*, with an AUM of ₹3,503 crore, has recorded a 73.6% return.

*ITI Small Cap Fund*, with an AUM of ₹2,085 crore, rounds off the list with a 69.4% return.

*The BSE 250 SmallCap TRI*, considered as the benchmark for active mutual funds in the small-cap segment, reported a 64.5% return over the same period, showcasing the outperformance of these funds against the broader market index.

Small-cap funds typically invest in stocks of companies with a _smaller market capitalisation._

These funds are considered *riskier* but have the potential for *higher returns* due to the growth prospects of smaller companies.

_ *Investing in small-cap funds can provide diversification to a portfolio, but it's crucial for investors to carefully assess their risk tolerance and investment goals before considering such funds.

While they offer growth potential, the higher risk associated with small-cap stocks necessitates a long-term investment horizon.*_

Comments

Post a Comment